The Coming Debt Trap: How Trump’s Economic Moves Could Reshape Your Financial Future

A hidden economic strategy involving gold, tariffs, and debt refinancing may be setting the stage for a historic wealth transfer—at your expense

I think I’ve figured out how the Trump administration could crash the economy and redistribute wealth on the backs of everyday Americans. How do I know? I’m not 100% certain, but several interesting and seemingly unrelated events have caught my attention.

In the early 2000s, I decided to get a Master’s in Business Administration. I loved every minute of it, especially micro and macroeconomics. To this day, I closely watch economic indicators to understand their implications.

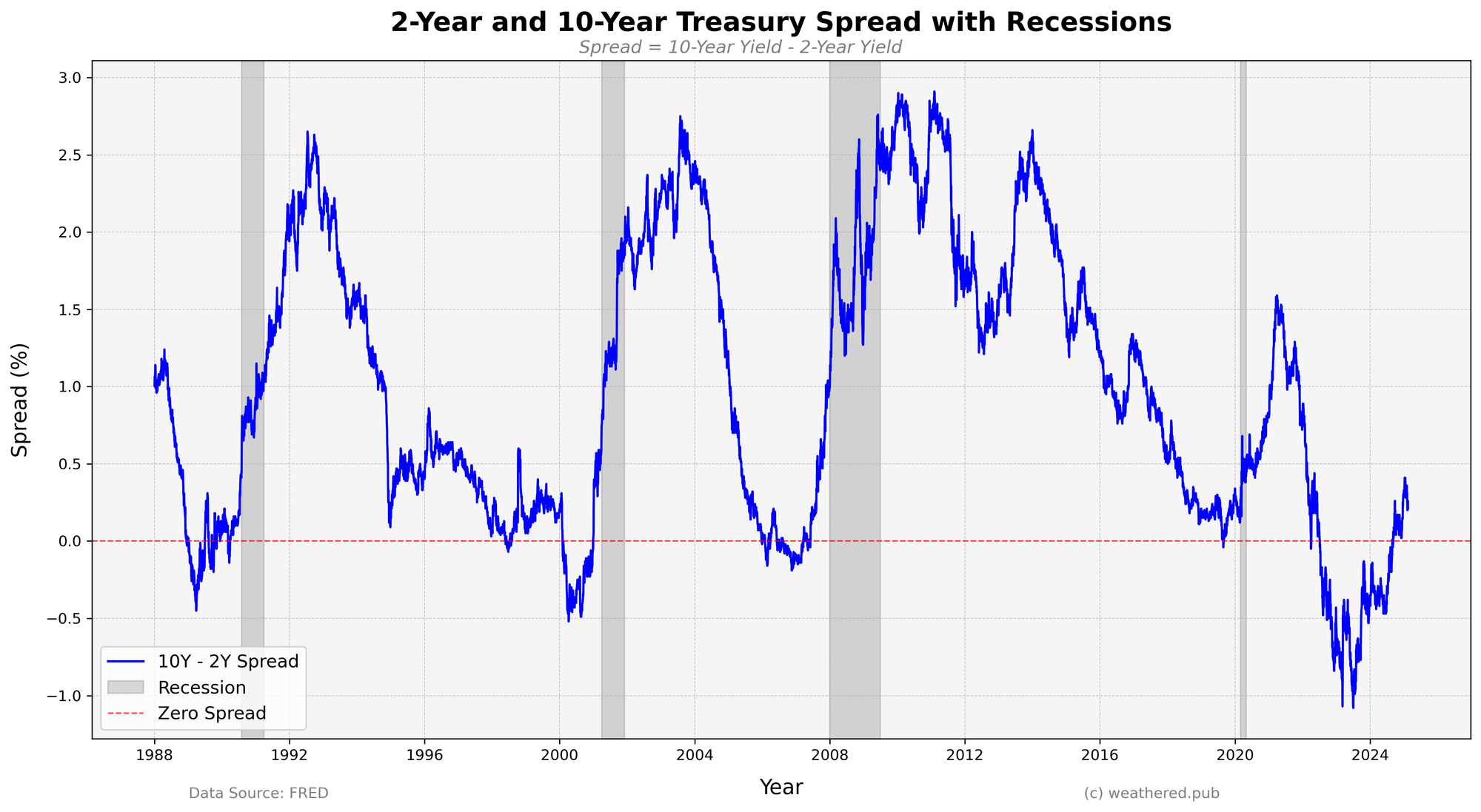

One of my go-to indicators for assessing economic health is the yield spread between the 2-year and 10-year Treasury bills. It’s simple to calculate: subtract the 2-year interest rate from the 10-year interest rate. If the result is positive, the debt markets are healthy—investors are rewarded with higher interest rates for holding long-term bonds.

That makes sense. If you’re tying up your money for ten years instead of two, you should receive more interest in return.

However, bond investors are highly sophisticated. They price in future expectations, such as recessions and inflation. When the 2-year yield exceeds the 10-year yield, the yield curve inverts—signaling trouble ahead.

Historically, an inverted yield curve has been a strong predictor of recessions. If you plot the 2-year/10-year yield spread using data from the St. Louis Federal Reserve (FRED) and overlay past recessions, you’ll see a clear pattern.

The most recent inversion began in 2023 and remained inverted through early 2024. That’s when I started looking for clues about when a recession might hit.

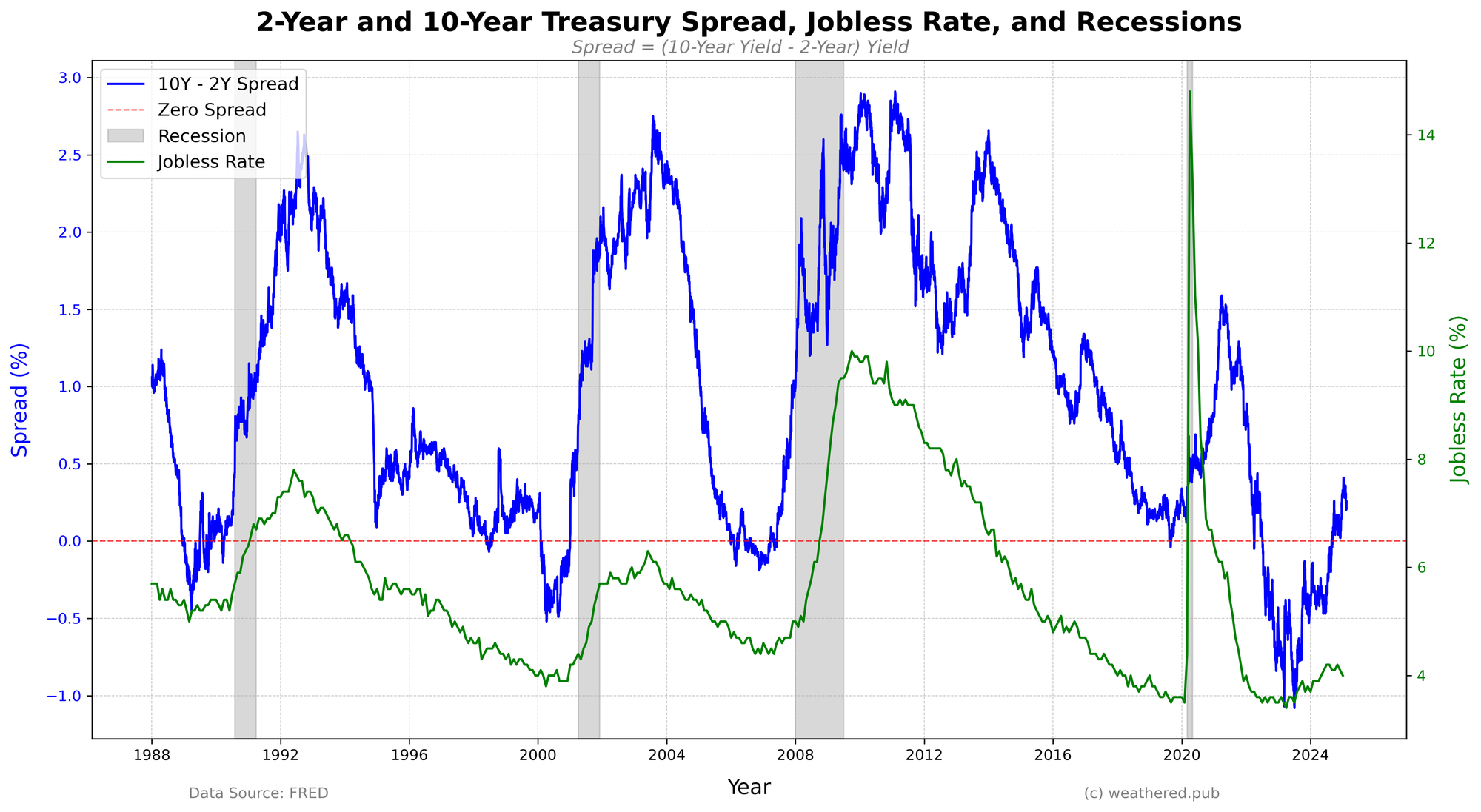

While inflation remains elevated, a full-blown recession has yet to materialize. I believe the primary reason is the low jobless rate.

If you overlay the jobless rate with the yield spread, you’ll notice a key relationship: when the yield spread is negative and the jobless rate begins to rise sharply, a recession follows.

Right now, unemployment remains low, but once it begins to rise rapidly, the recession will arrive—and it could be a severe one, given the length of the inversion. The likely trigger? A combination of high inflation (possibly exacerbated by tariffs) and mass layoffs.

Yet, a recession alone doesn’t explain everything. Economic downturns happen, but they don’t always come with deliberate structural shifts in wealth and power. This time, however, there are signs that something deeper is at play.

The usual economic warning lights—yield curve inversions, inflation, and unemployment trends—are flashing, but they may not just be signaling a recession. They could be signaling an intentional financial maneuver, one designed not to mitigate economic hardship but to exploit it.

At the center of this potential shift lies Trump’s Sovereign Wealth Fund, a push for gold audits, and the rising price of gold itself.

The Trump Sovereign Wealth Fund & Gold Revaluation

For months, gold prices have been climbing steadily, approaching an all-time high of $3,000 per ounce. Under normal circumstances, gold serves as an inflation hedge, reacting to a declining U.S. dollar and economic uncertainty.

But this surge may signal something more. What if it’s not just inflation but a prelude to a broader financial strategy? Trump has long admired the Gilded Age and understands debt manipulation better than most—after all, he built his empire on it. What if he’s planning a massive bait-and-switch with U.S. debt, shifting the burden onto the public?

When I read that Trump planned to establish a Sovereign Wealth Fund, I immediately suspected it would benefit him and his wealthy allies. Then, I came across another piece of news: Elon Musk and Rand Paul advocating for an audit of U.S. gold reserves.